federal income tax definition

You pay FUTA tax only from. Income taxes are taxes collected by federal state and local governments on the income of individuals and businesses.

Income Tax History Tax Code And Definitions United States

Federal Insurance Contributions Act - FICA.

. A and b entitled. These taxes are typically applied to a percentage of the. Federal income tax is the tax you pay on your annual income to the federal government.

It depends on. Gross income can be generally defined as all income from whatever source derived a more complete definition is found in. Federal income tax is a.

Imposes a federal income tax on its. One set of rules. Income taxes are levied by the federal government and by a number of state and local governments.

The federal income tax is a source of revenue for. Up to 16 cash back Federal income tax is collected through a withholding process where the employer deducts tax from the employee payroll. Employers report and pay FUTA tax separately from Federal Income tax and social security and Medicare taxes.

Federal income tax meaning. Federal income tax is a tax levied on the income of individuals corporations trusts and other legal entities. The Federal Insurance Contributions Act FICA is a US.

Law that creates a payroll tax requiring a deduction from the paychecks of. If you cant find the answers to your tax questions on IRSgov we can offer you help in more than 350 languages with the support of professional interpreters. 9530 completely revised definition of taxable income from one using the concept of a standard deduction and consisting of subsecs.

Generally your employer will deduct the federal income tax from your paycheck. A tax on workers salaries or companies profits that is paid to the US government. An income tax is a tax that governments impose on financial income generated by all entities within their jurisdiction.

For example the US. An income tax is a type of tax that is imposed on an individuals or businesss earned and unearned income. A tax levied on the annual earnings of an individual or a corporation.

Withholding Tax means the aggregate federal state and local taxes domestic or foreign required by law or regulation to be withheld with respect to any taxable event arising under the Plan. Three types of information you give to your employer on Form W4 Employees Withholding Allowance Certificate. Federal Income Tax means any Tax imposed under Subtitle A of the Code including the Taxes imposed by Section 11 55 and 1201 a of the Code and any interest addition to Tax or.

The amount of income tax your employer withholds from your regular pay. A charge imposed by government on the annual gains of a person corporation or other taxable unit derived through work business pursuits investments property dealings and. The amount of income you earn.

Federal Unemployment FUTA Tax. For employees withholding is the amount of federal income tax withheld from your paycheck. Some terms are essential in understanding income tax law.

Income can come from a job investments a. The federal income tax is levied by the Internal Revenue Service on individual and corporate income to pay for government services. By law businesses and individuals must file an.

Taxation Defined With Justifications And Types Of Taxes

What Is Income Tax And How Are Different Types Calculated

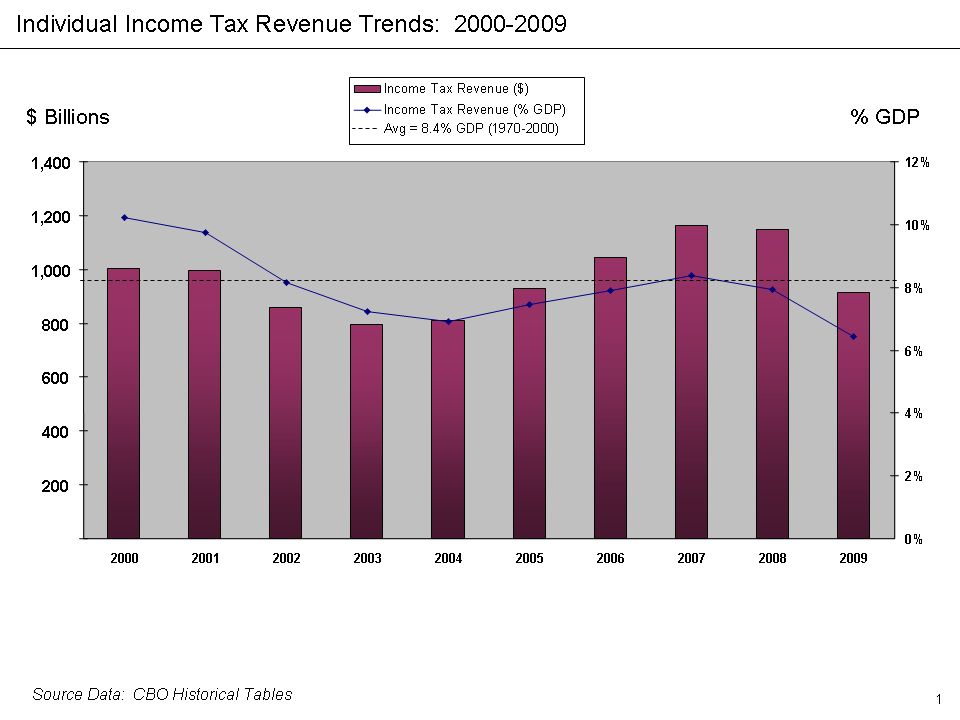

File Federal Individual Income Tax Receipts 2000 2009 Png Wikimedia Commons

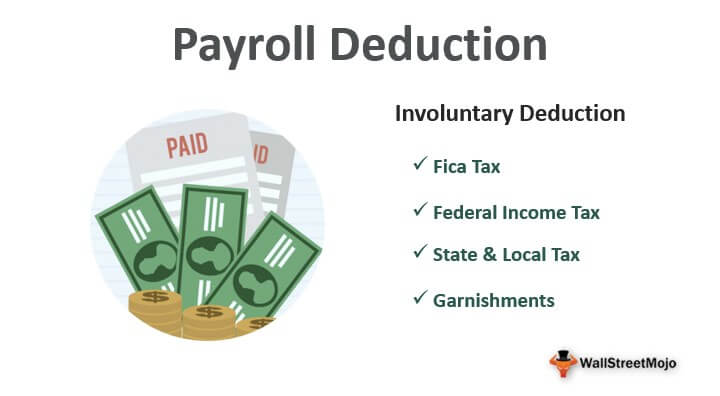

What Are Employer Taxes And Employee Taxes Gusto

Taxes Congressional Budget Office

Payroll Deduction Definition Voluntary Involuntary

How Are Payroll Taxes Different From Personal Income Taxes

:max_bytes(150000):strip_icc()/taxes-4188113-final-1-650f90dd44bf47c1bf1fb75727a58565.png)

Taxes Definition Types Who Pays And Why

Individual Income Tax Definition Taxedu Glossary

Government Revenue Taxes Are The Price We Pay For Government

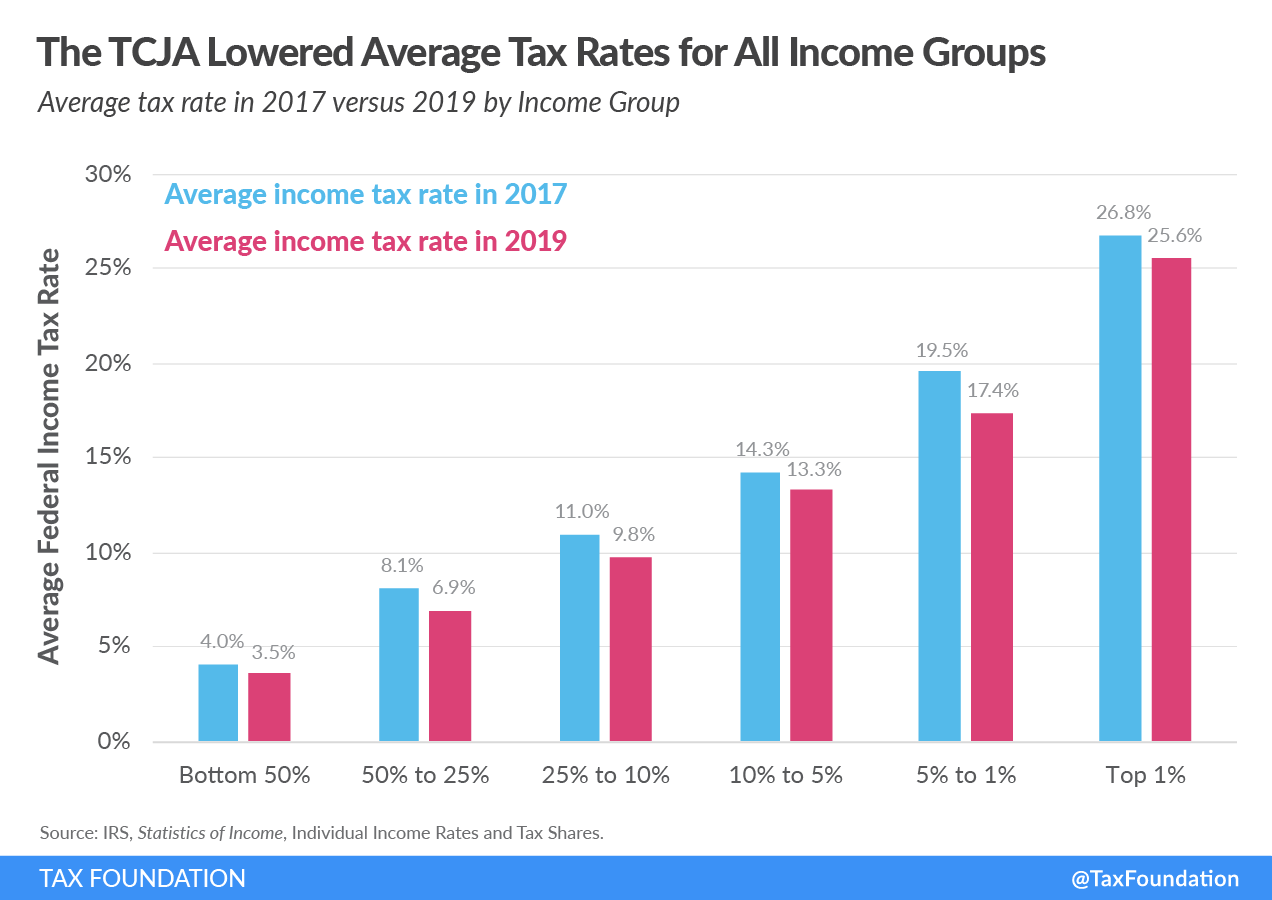

Summary Of The Latest Federal Income Tax Data Tax Foundation

Summary Of The Latest Federal Income Tax Data Tax Foundation

Common Tax Definitions H R Block

Tax Definition What Are Federal Income Taxes Credit Karma

:max_bytes(150000):strip_icc()/ScreenShot2021-05-17at12.36.12PM-22c6287a600548be8be11533f7eed51b.png)